Core competence and the resource-based view are concepts in strategic management that focus on leveraging internal capabilities and resources to achieve a sustainable competitive advantage. Let’s briefly explore each concept:

Core Competence:

Definition: Core competence refers to the unique and integrated set of capabilities, knowledge, and skills that distinguish a company and enable it to deliver value to customers.

Key Points:

- Core competencies are the collective knowledge, expertise, and technologies that underlie a company’s products or services.

- They are activities or processes that a company performs exceptionally well and are critical to its competitive success.

- Core competencies contribute to creating a competitive advantage by providing access to a wide variety of markets, making a significant contribution to customer benefits, and being difficult for competitors to imitate.

Resource-Based View (RBV):

Definition: The Resource-Based View is a theoretical framework that focuses on the internal resources and capabilities of a firm as the key sources of sustainable competitive advantage.

According to RBV, a firm’s unique resources and capabilities, which can be tangible or intangible, determine its ability to gain and sustain a competitive advantage.

The RBV suggests that not all resources are equally important; only resources that are valuable, rare, difficult to imitate, and non-substitutable (VRIN) can lead to a sustained competitive advantage.

The RBV contrasts with the traditional external-focused approaches that emphasize industry structure and competitive forces.

Resources can be broadly categorized into tangible and intangible assets. Here are examples of each:

Tangible Resources:

-

Physical Assets:

Example: Manufacturing plants, machinery, equipment, real estate, and infrastructure.

-

Financial Resources:

Example: Cash, financial reserves, credit lines, and investments.

-

Technological Resources:

Example: Computer systems, software, hardware, and other technology infrastructure.

-

Organizational Resources:

Example: Physical organizational structure, distribution networks, and supply chain.

-

Inventory:

Example: Raw materials, work-in-progress, and finished goods.

-

Real Estate:

Example: Land, buildings, and facilities owned by the organization.

-

Human Resources:

Example: Skilled labour, workforce, and employee expertise.

-

Raw Materials:

Example: Materials used in the production process, such as metals, plastics, or chemicals.

Intangible Resources:

-

Intellectual Property:

Example: Patents, trademarks, copyrights, and trade secrets.

-

Brand Equity:

Example: Brand recognition, brand reputation, and customer loyalty associated with the brand.

-

Human Capital:

Example: Employee skills, knowledge, experience, and expertise.

-

Innovation and Research Capabilities:

Example: Research and development capabilities, innovation processes, and proprietary knowledge.

-

Corporate Culture:

Example: Shared values, beliefs, and practices that shape the behaviour and attitudes of employees.

-

Customer Relationships:

Example: Strong relationships with customers, customer loyalty programs, and customer databases.

-

Reputation:

Example: Goodwill, positive public perception, and a favourable reputation in the industry.

-

Strategic Alliances and Partnerships:

Example: Collaborative agreements with other organizations, joint ventures, and strategic partnerships.

-

Employee Relations:

Example: Positive relationships between employees and management, effective communication channels, and employee engagement.

-

Organizational Knowledge:

Example: Institutional knowledge, best practices, and insights gained through experience.

Successful organizations often leverage a combination of tangible and intangible resources to create a competitive advantage and drive long-term success. The strategic management of these resources is crucial for sustaining a competitive edge in the dynamic business environment.

WATCH THE VIDEO HERE>>>

Heterogeneous Resources in RBV:

Heterogeneous resources refer to the differences in resources across firms. According to RBV, not all resources are created equal. Firms have unique combinations of resources that differ in terms of their nature, quality, and deployment. These differences can arise from various sources, including historical factors, managerial decisions and experiences, management practices, strategic investments, skills, and expertise.

The RBV emphasizes the importance of heterogeneity because it suggests that firms can gain a competitive advantage by leveraging their unique set of resources. By possessing resources that are rare or difficult to replicate, firms can achieve superior performance compared to their competitors.

Immobile Resources in RBV:

Immobile resources are those that are difficult for competitors to replicate or acquire. These resources are typically firm-specific and cannot be easily transferred or duplicated by competitors. Immobile resources include tangible assets like specialised machinery or unique locations, as well as intangible assets like proprietary technology, brand reputation, or organizational culture.

The immobility of resources is a key factor in sustaining competitive advantage over the long term. If resources were easily transferable or replicable, firms would not be able to maintain their uniqueness and competitive position in the market.

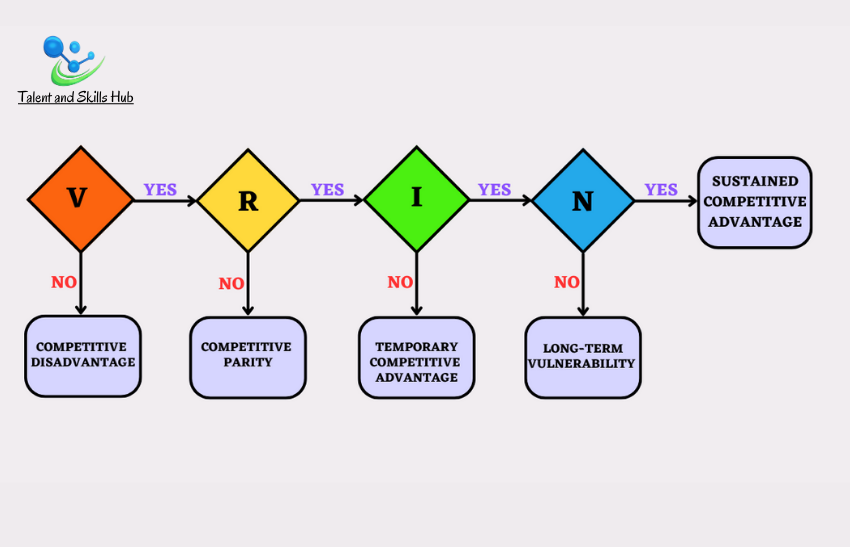

VRIN Framework for Sustained Competitive Advantage.

The VRIN framework, introduced within the Resource-Based View (RBV) of strategic management, outlines the criteria that resources must meet to contribute to a sustained competitive advantage. VRIN stands for Valuable, Rare, Inimitable, and Non-substitutable. Here’s how each criterion contributes to a sustained competitive advantage:

-

Valuable:

A resource is valuable if it enables a firm to exploit opportunities or defend against threats. A valuable resource contributes to a competitive advantage by allowing the firm to perform activities more efficiently, provide unique value to customers, or respond effectively to market demands.

Example: A strong brand reputation can be valuable, as customers may prefer products or services from a trusted and recognized brand.

-

Rare:

A resource is rare if it is not commonly possessed by other competitors. Rarity is crucial because if a resource is widely available, it won’t provide a competitive edge. Rare resources are more likely to contribute to sustained competitive advantage as they differentiate a firm from its competitors.

Example: A patented technology or exclusive access to a rare natural resource can be considered rare.

-

Inimitable (Difficult to Imitate):

A resource is inimitable if it is challenging for competitors to replicate or imitate. Contribution to Competitive Advantage: Resources that are difficult to imitate can lead to a sustained competitive advantage because competitors cannot easily duplicate the benefits derived from those resources.

Example: Proprietary technologies, unique organizational culture, or complex supply chain relationships may be difficult for competitors to replicate.

-

Non-substitutable:

A resource is non-substitutable if there are no equivalent alternatives that can produce the same benefits. Non-substitutability ensures that competitors cannot easily replace or replicate the benefits provided by a resource, further strengthening the firm’s competitive position.

Example: Exclusive access to a scarce resource that has no equivalent substitute in the market.

Having an inimitable but substitutable resource can result to short-term advantage or long-term vulnerability. In the short term, the firm may enjoy a competitive advantage derived from the inimitability of the resource. Competitors find it challenging to replicate the resource directly, giving the firm a unique position in the marketplace. This can lead to increased market share, higher profits, or other benefits associated with being the sole provider of that particular resource.

However, over the long term, the substitutability of the resource exposes the firm to risks. Competitors may develop alternative solutions or technologies that offer similar benefits, thereby diluting the uniqueness of the firm’s offering. As substitutes become available, the firm’s competitive advantage diminishes, and it may struggle to maintain its market position or premium pricing.

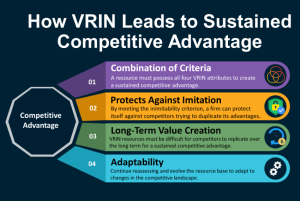

How VRIN Leads to Sustained Competitive Advantage:

- Combination of Criteria: A resource must possess all four VRIN attributes to create a sustained competitive advantage. If any criterion is lacking, the advantage may be temporary or easily eroded.

- Protects Against Imitation: By meeting the inimitability criterion, a firm can protect itself against competitors trying to duplicate its advantages. Even if competitors recognize the value of a resource, the difficulty of imitation serves as a barrier.

- Long-Term Value Creation: Resources meeting the VRIN criteria are not only valuable in the short term but are difficult for competitors to replicate over the long term, contributing to sustained competitive advantage.

- Adaptability: The VRIN framework encourages firms to continually reassess and evolve their resource base, ensuring that the criteria are maintained or enhanced to adapt to changes in the competitive landscape.

Final Remark

The Valuable, Rare, Inimitable, and Non-substitutable (VRIN) framework provides a strategic lens through which firms can evaluate their resources to determine their potential to contribute to a sustained competitive advantage. Resources that meet all four criteria are more likely to create and maintain a unique and enduring position in the marketplace.

References

Barney, J. B. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1), 99–120.

Barney, J. B. (2001). Resource-Based Theories of Competitive Advantage: A Ten-Year Retrospective on the Resource-Based View. Journal of Management, 27(6), 643–650.

Peteraf, M. A. (1993). The Cornerstones of Competitive Advantage: A Resource-Based View. Strategic Management Journal, 14(3), 179–191.

Wernerfelt, B. (1984). A Resource-Based View of the Firm. Strategic Management Journal, 5(2), 171–180.

Collis, D. J., & Montgomery, C. A. (1995). Competing on Resources: Strategy in the 1990s. Harvard Business Review, 73(4), 118–128.

Grant, R. M. (1991). The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation. California Management Review, 33(3), 114–135.